售前服务

一、公司拥有一批经验丰富的技术人员,为客户提供详细的产品参数及技术指导。

二、专业的一对一售前服务,为客户提供及时的信息沟通。

三、免费设计图纸,为客户提供专业的自动化生产布局。

四、免费为客户打样,为客户提供符合自身需求的自动化机械设备。

我们的优势

一、我司拥有一批经验丰富的机械与电气工程师,为客户提供优质的解决方案。

二、所有客户进行一对一售前与售后的跟踪服务,确保客户的设备正常的运行使用。

三、可根据客户需求对设备的机械及电气部分进行定制化生产加工。

四、我司拥有专用的售后服务车,对每套生产线进行每年三次的巡检。

售后服务

一、整机质保一年,终身提供有偿的售后服务支持。

二、提供7*24小时的电话服务,为客户提供及时的服务解决方案。

三、所有线体设备都经过出厂模拟测试,各项参数合格后才能交付使用。

四、每套自动化设备出厂后由专业的售后服务工程师一对一进行服务。

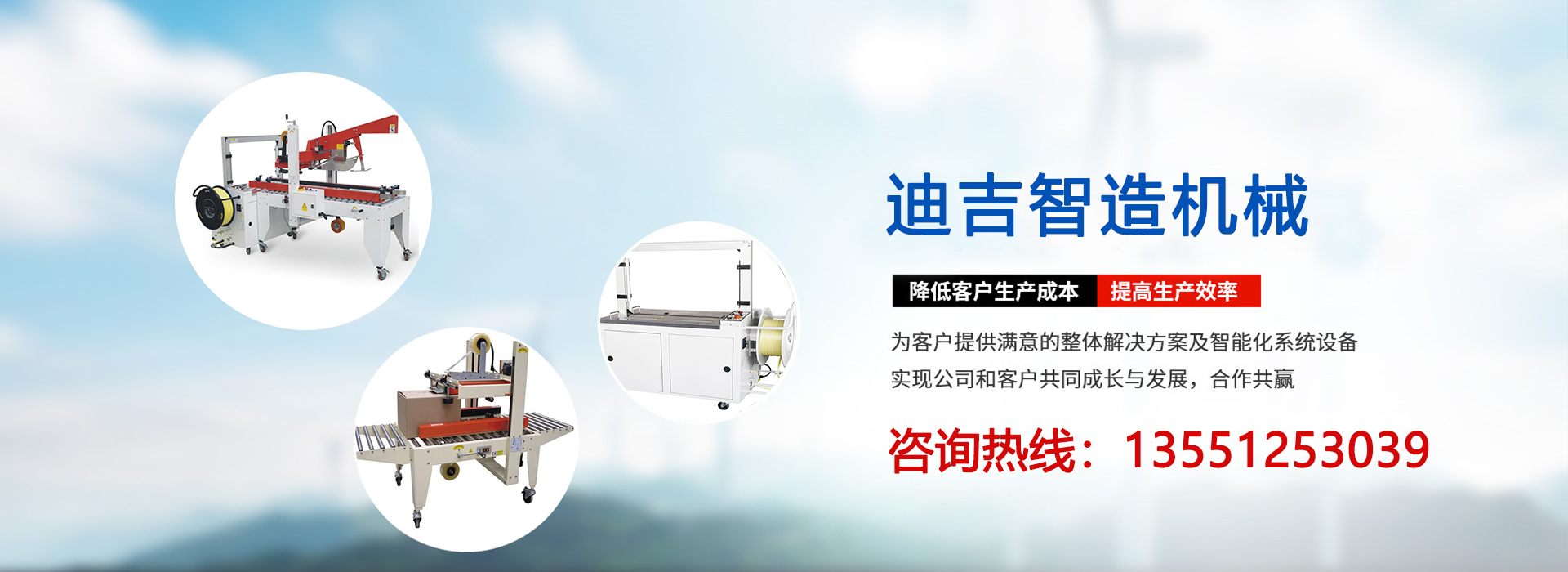

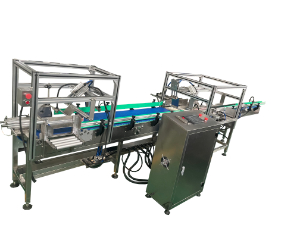

热销产品全部/贴标与套标机/封箱与打包机/u球体育(中国)股份有限公司与装箱机/输送与热缩机

贴标与套标机

自动贴标机是将标签自动的贴在产品上,该机型可单独适用也可以配合生产线使用,机型可根据用户的实际情况贴单张及多张标签同时在一个产品上面。

封箱与打包机

打包机又称捆扎机,打包机是使用打包带缠绕产品或包装件,然后收紧并将两端通过热效应熔融或使用包扣等材料连接的机器。该自动打包机适合常规物体捆扎,能保证包件在运输、贮存中不因捆扎不牢而散落,同时还应捆扎整齐美观。

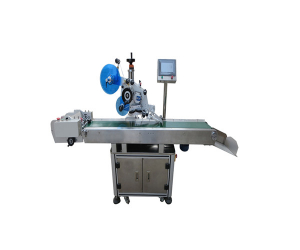

u球体育(中国)股份有限公司与装箱机

生产线输出的产品,经过自动装箱,再通过自动喷码、封箱后由动力滚筒输送线输送到纸箱规整排列平台上,纸箱规整排列装置将纸箱根据码垛排列要求,规整排列好,然后码垛机器人将纸箱按各自产品的码盘要求码垛在托盘上

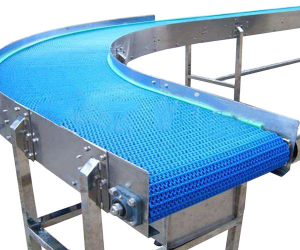

公司介绍

u球体育(中国)股份有限公司坐落于天府之都(四川成都),公司一致致力于自动化包装生产线、自动u球体育(中国)股份有限公司-封箱-捆扎线、自动贴标与套标线、自动化输送系统、非标自动化系统等设备的研发、生产与销售。

公司经过多年的发展建立了强大的售前、售中及售后服务团队,针对不同生产企业特点量身定制独特的解决方案,公司产品涉及领域有食品行业、制药行业、日化行业、化工行业、军工、航天科技、汽车零部件制造、民爆行业、电子产品、家具行业、新能源行业等。

“为客户提供高质量的包装设备;让工厂包装自动化变的简单”是公司一直坚持的宗旨;“为客户提供高品质的服务体系”是公司对每一位客户不变的原则。

- 2024年春节放假通知2024-02-01

- 春节放假通知2022-01-18

- 国庆放假通知2021-09-28

- 端午节放假通知2021-06-12

- 五一放假通知2021-04-23

新闻动态全部查看

行业新闻

- 自动双面贴标机应用于水果行业快速2023-12-25

- 块状光学玻璃的自动称重应用2021-07-17

- 皮带输送机的分类2021-02-02

- 捆扎机(打包机)的分类2021-01-31

- 全自动贴标机在外包装工序中的优势2021-01-27

- 自动打包机在企业快速包装中的重要2021-01-23

- 自动u球体育(中国)股份有限公司机与人工u球体育(中国)股份有限公司的差距2021-01-22

- 自动贴标机的分类2021-01-22

- 包装机械的推广推动社会经济的发展2020-12-26

技术知识

- 自动封箱打包机一体机在医疗机械领2021-06-12

- 关于夏日贴标机出现出标不稳定的原2021-06-02

- 全自动在线定位圆瓶贴标机在医用辅2021-03-25

- 自动封箱打包机一体机在智能燃气表2021-03-24

- u球体育(中国)股份有限公司机对纸箱的要求2021-03-04

- 贴标机解决精度误差偏大的快速方法2021-01-27

- 套标机经常出现高标的原因分析2021-01-23

- 套标在工作时经常出现标签拉断的原2021-01-23

- u球体育(中国)股份有限公司的日常简单维护2021-01-16

- 关于贴标机在贴标后标签起翘的问题2021-01-04

- 贴标机选购指南2020-12-28